2023 Central Texas Housing Market Report

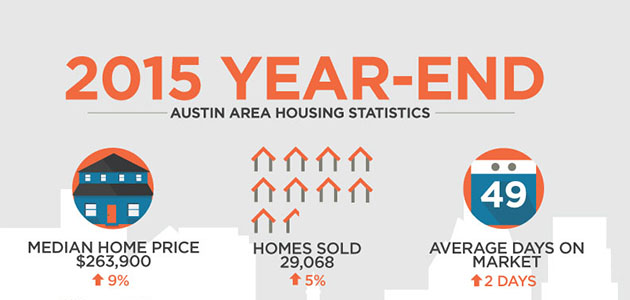

AUSTIN, TX — In 2023, the median price for a home in the Austin-Round Rock MSA decreased 10.2% to $450,000, according to the Austin Board of REALTORS® December 2023 and Year-End Central Texas Housing Market Report. When compared to the steep 24.2% decline in pending sales in 2022, 2023 saw a slight 3.0% decline to 30,353 sales emphasizing that the Central Texas housing market continues to find its footing despite macroeconomic factors impacting the broader housing market and economy.